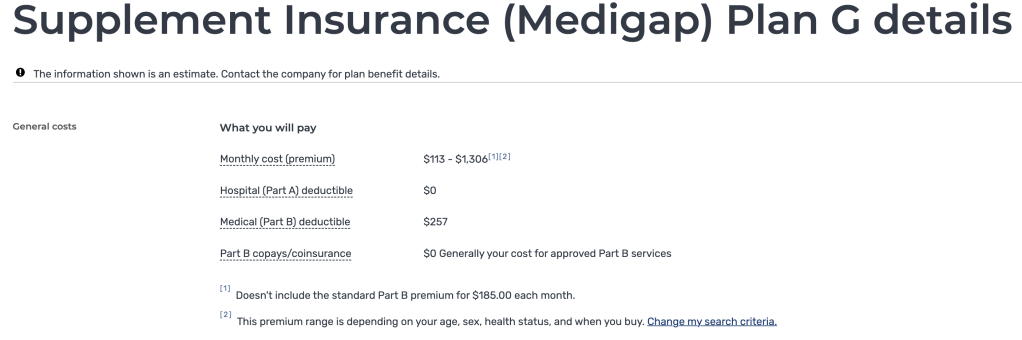

Premiums

This is the amount you pay each month to have coverage in a health insurance plan. Sometimes some of this cost is covered by an employer, tax credits through the Federal Marketplace, or covered by state programs like Medicaid.

Deductible

This is the first amount of money you are responsible for when going to the hospital, or surgeries etc. Sometimes prescription drug plans have deductibles. You always have to pay the deductible first before coinsurance kicks in. If your deductible is equal to your MOOP then you will have no more out of pocket costs for covered services for the plan year.

Out of Pocket MAX (MOOP)

This is the most you will have to pay for covered services until the plans yearly end. Some plans follow the calendar year, and some like group plans can start in the middle of the year. Sometimes your MOOP is the same as your deductible. Once you hit your MOOP then you will have no more out of pocket costs for covered services for the plan year.

The MOOP for a family is twice an individual’s rate. If your MOOP is $9,100 then the most your family is going to pay for everyone’s healthcare costs for the entire plan year is $18,200

The MOOP is different for in network services than out of network, it’s recommended to stay in network but if you have to go out of network reach out to Miss Katie to review your plan details.

Copay

You might see copays is your plan Doctors or Specialists, copays are the rate that you’ll pay for those appointments without having met your deductible up until you have met your out of pocket max. Not all plans have copays.

Coinsurance

Coinsurance is usually a percentage that you are responsible for after you have met your deductible for things like an emergency room visit, or surgeries. Not all plans have coinsurance.

In Network

These doctors, specialists, and hospital groups have agreed to specified rates with your insurance company. This helps reduce the charges that occur and help to save consumers money and keep costs down.

Out of Network

Sometimes your plan will offer coverage out of network (often at a higher rate than in network), this varies from plan to plan. Sometimes you will see a MOOP for your out of network costs, but not always. It is EXTREMLY rare that out of network costs would go towards your in network MOOP, or that you would see these charges combined. Some plans like HMO’s and the Blue Cross Blue Shield – Blue Focus Plans will not cover anything at an out of network doctor or hospital, except in a life or death emergency.

First payer

When you have multiple plans, ie health insurance and Medicaid, or Original Medicare/Medicare Advantage and CampVA, you will see one plan listed as first payer or second payer. Please contact Miss Katie if you have more questions regarding multiple insurances or programs and how they will work together for you.

If you have questions about your health insurance plan or options call Miss Katie Your insurance lady

Here to answer your health & life insurance questions!

Leave a comment