If you have an option to pay less, but you want to pay more to have less out of pocket costs in the future then I believe that you should have as much of your bills covered as possible for that additional cost.

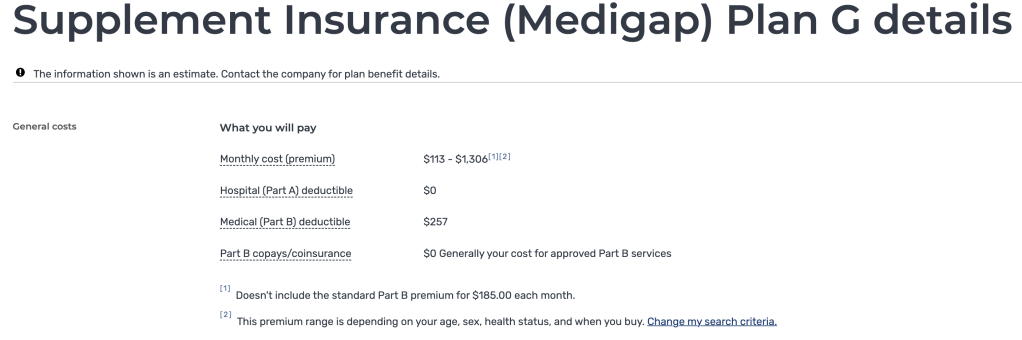

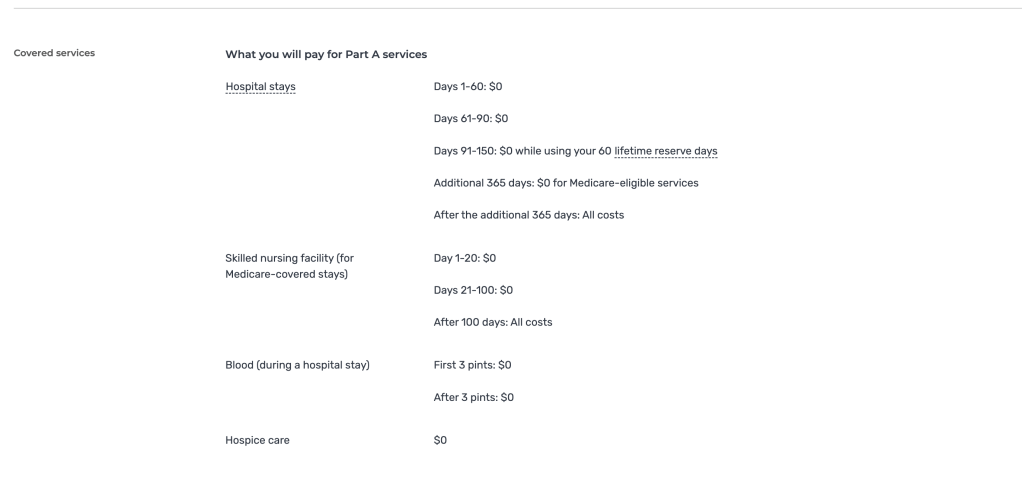

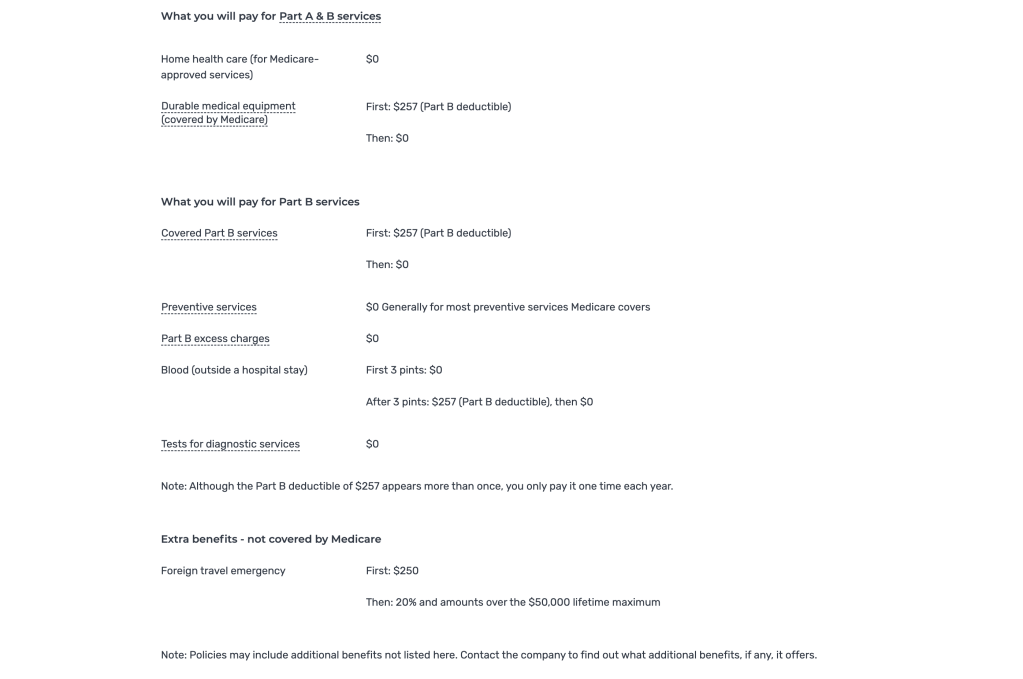

Do you see all those zeros?? That means this plan, if you pay for it, leaves you with just a Part B deductible (that changes yearly, but is $257 for 2025) and your premiums. Especially if the total annual cost for you is less than the Max out of pocket with another offer of coverage then that is an amazing benefit to take advantage of.

This could be a good choice if you like consistency in knowing exactly what you healthcare costs are going to be.

Premiums plus Part B deductible. Always

This could be a good choice if you don’t want to worry about COPAYs COINSURANCE or Max out of pocket costs, Limits/ exclusions and the potential a bill is denied by the insurance carrier (if it’s covered under Medicare, it’s covered by a Medicare Supplement plan G after the part B deductible of $257 for 2025 has been met. Always

You will want to add a PDP or stand alone prescription drug plan to this Medicare Supplement coverage

Leave a comment