If you’re brand new to Medicare, welcome!

I know it can feel like there are a hundred moving parts, new terms to learn, and deadlines to meet. Medicare can even feel like it’s own language!

Your Medicare coverage choice is personal—there’s no one-size-fits-all answer. The right plan for you is the one that fits your health, lifestyle, and budget. That’s where I come in.

This is your “easy” guide to how Medicare works in 2025, what it costs, and how to choose what’s right for you. Think of Original Medicare like the foundation of your house—you can’t skip it, but you can (and probably should) add on to make it more comfortable and protective.

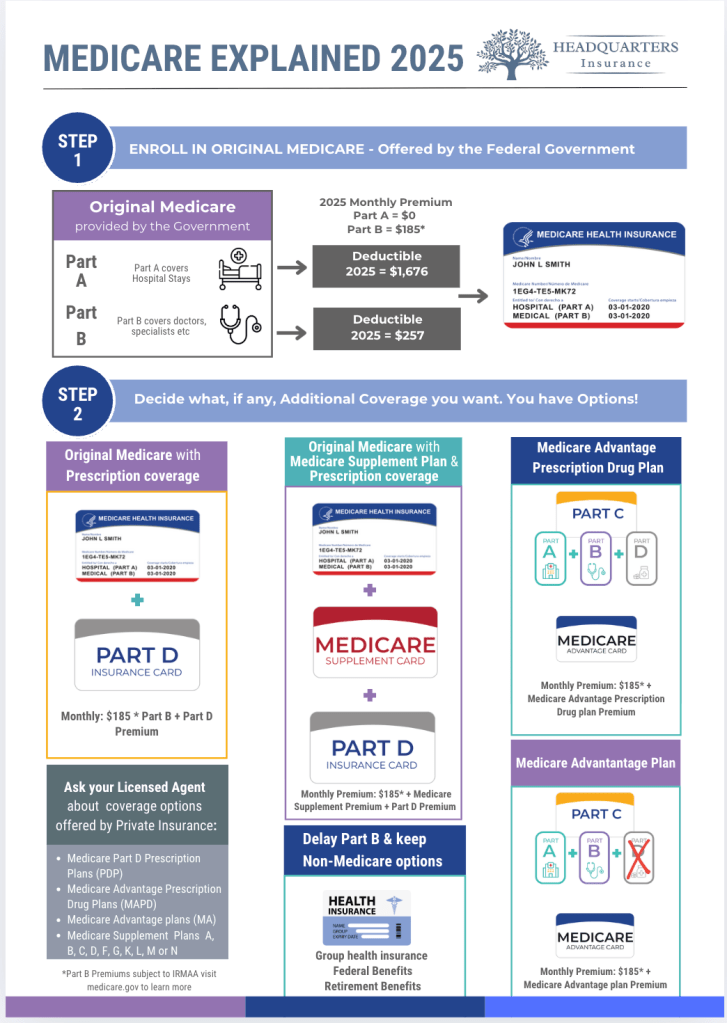

STEP 1: Enroll in Original Medicare

[Parts A & B] through Social Security

Original Medicare is offered by the federal government and is made up of two main parts. These 2 parts cover roughly 80% of all of your (Medicare allowable) medical bills.

If you just have Original Medicare part A & part B, you will have the outlined deductibles in this graphic and about a 20% coinsurance for your care, with no maximum or limit- ever.

We are lucky to have have the option of Original Medicare, but with my help, I can add additional coverage that protects us better.

Think about this example… If you have $350,000 in care in one year; with just Part A & Part B of Medicare you will be responsible to pay $70,000 in bills for this care. I don’t know about you, but I never want to be responsible for $70k in medical bills!

Let’s break down Orginal Medicare, and then we’ll go into additional options for coverage we can add to cover us better.

Part A – Hospital insurance

- Covers hospital stays, skilled nursing facilities, hospice, and some home health care.

- Premium: $0 for most people (you’ve already paid into it through payroll taxes).

- Deductible in 2025: $1,676 per benefit period.

Part B – Medical insurance

- Covers doctor visits, specialists, outpatient care, preventive services, and some medical equipment.

- Premium in 2025: $185/month*

- Deductible in 2025: $257 per year.

*If your income is higher, Medicare may charge an extra amount (called IRMAA).

STEP 2 : Decide on Additional Coverage

Once you’re enrolled in Original Medicare, you need to decide if you want to add more coverage. This step is all about protecting yourself from high out-of-pocket costs and making sure your prescriptions are covered.

Remember the above example? We don’t want to be responsible for 20% of our Medical bills. If your bills total $350,000 that $70,000 that you are responsible to pay towards this care.

Here are your main paths:

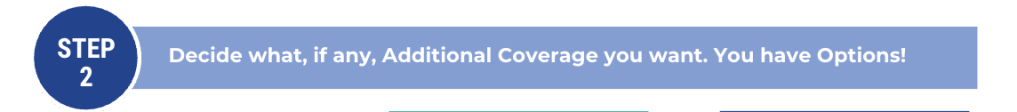

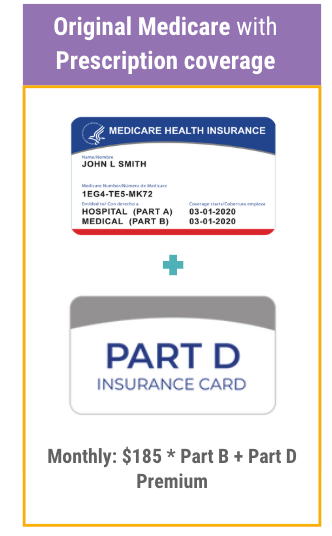

Path 1: Original Medicare + Prescription Coverage (Part D)

You can stick with Original Medicare, pay the 20% for all your bills and just add a separate Part D plan for prescription drugs.

- Part D (or PDP – prescription drug plans) are managed by private insurance companies.

- Your total monthly cost will be: $185 (Part B) + Your Part D premium.

Good for: People who don’t mind paying deductibles and coinsurance when they use care, but want drug coverage. Keep reading to see other options available to you; we’re getting to ones that cover that 20% I mentioned before.

*Please note* Many Medicaid eligibles have this level of Medicare coverage. That’s a different situation all together, if that is your circumstance please book and appointment with me to go over your options.

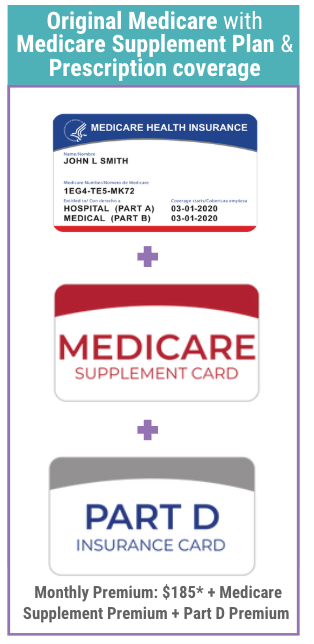

Path 2: Original Medicare + Medicare Supplement + Prescription Coverage

This is often termed “Original Medicare with a Medigap plan.”

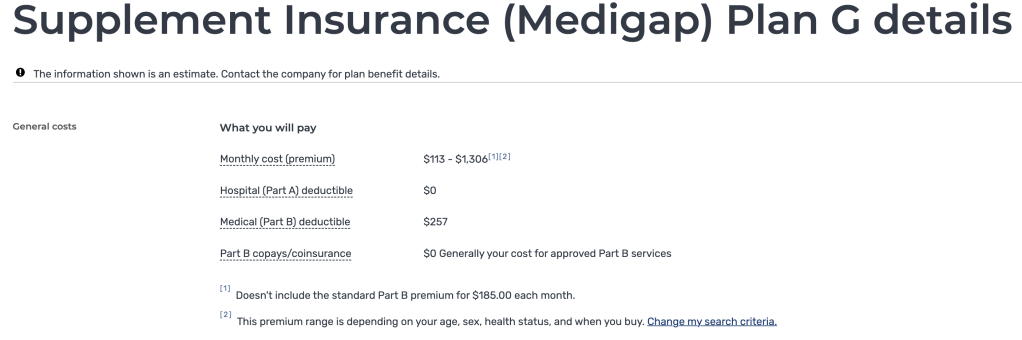

- Medicare Supplement (Medigap) plans help pay for the deductibles, copays, and coinsurance that Original Medicare leaves behind. You’ll recognize these by their names: “Plan G” “Plan F” “Plan N” etc…

- If you don’t have prescription coverage from the VA or IHS then you still need a Part D plan for prescriptions.

Your total monthly cost will be: $185 (Part B) + Medicare Supplement premium + Part D premium.

Good for: People who travel often, want predictable medical costs, and want the freedom to see any doctor who accepts Medicare.

Path 3: Medicare Advantage Prescription Drug Plan (“Part C” or “MAPD”)

A Medicare Advantage plan combines Part A + Part B + usually Part D into one plan.

- These are run by private insurance companies.

- You’ll pay your Part B premium ($185 in 2025) plus any plan premium (many are $0).

- Often includes extras like dental, vision, and hearing.

- May include a gym membership

- Must use the plan’s network of providers (except for emergencies).

Good for: People who want one plan with added benefits and are comfortable staying in-network. Want to pay for care with specified copays as it’s incurred vs a higher monthly premium. Anyone whose health history makes them ineligible for a medicare supplement plan.

Often times when someone’s premiums for their Medicare supplement plan is costing them more than the Maxium out of pocket (MOOP) for an advantage plan, it feels like they are over spending and would save money even if they met their MOOP. Remember, everyone’s situation and needs are different, but you have a licensed local agent (me! Miss Katie Your Insurance Lady) here to help you! Reach out!

Path 4: Medicare Advantage Plan {Without Drug Coverage} (“Part C” or “MA plan”)

This is a plan for people who have prescription coverage from another source, like the VA, a retiree plan or Indian Health Service. But they want additional help with the 20% of Original Medicare that they are responsible for.

- Combines Part A and Part B in one plan

- No Part D included so there is no drug coverage

- Sometimes includes a Part B Giveback

- May include a gym membership

- Often includes extras like dental, vision, and hearing.

- You’ll pay your Part B premium ($185 in 2025) plus any plan premium (many are $0) minus the Part B Giveback (if their is one).

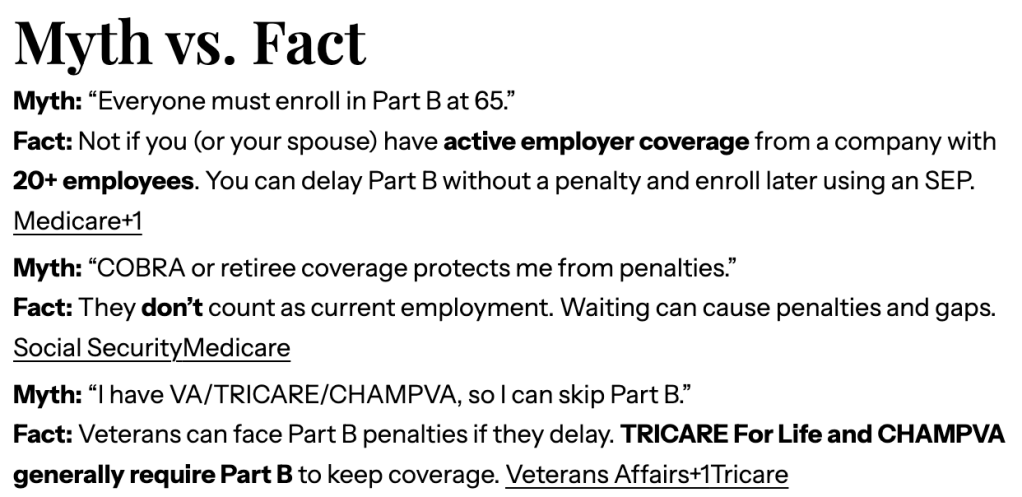

There is a myth going around that ‘Veterans do not need to enroll in Medicare’ this is FALSE – EVERY AMERICAN AT AGE 65 IS ELIGIBLE FOR MEDICARE. Full stop.

These MA plans we designed for their exact situation, tailored to their needs and are often called “Honor Plans” – HUMANA or “Patirot plans” – United Healthcare and are even cobranded with organizations like USAA (HUMANA)

Path 5: Delay Part B and Keep Other Coverage

If you or your spouse are still working and have employer coverage, you might consider staying in that coverage and delaying Part B until you retire—this avoids paying the premium until you actually need it. If you’re employer has more than 20 employees they will be “first payor” and Medicare will never be billed for your care. If they have less than 20 employees then you should be in Medicare because they are “first payor” and your employer coverage will never be billed for your care. Having both will only ever cause a billing hastle and it is not recommended.

- Also applies to certain federal or retiree benefit plans.

- Important: Always confirm with your employer or a licensed agent to avoid late penalties later.

- There are lot of things to consider in this senario, and if this is you; please please please connect with me to talk through your options.

If you choose to stay in your group’s coverage please confirm with SSA that you are not enrolled in Part B. I would hate to have to tell you that you wasted $185 or more a month for however long you didn’t need to be enrolled. This breaks my heart, and trust me, there is no way to get it back- like breaking the law, you are ‘guilty even if you didn’t know.’

PLUS you miss out on enrollment windows and it makes an already confusing and messy process, harder and more complicated.

There’s a chance you could miss your opportunity for a medicare supplement plan entirely, and if that’s the option you want later, I’d hate to see you miss it!

Choosing Your Best Option

Ask yourself:

- Do I want flexibility to see any Medicare provider nationwide, or am I fine with a national network of doctors?

- What’s more important—lower monthly premiums? Lower cost bills?

Put another way:

save money and have more risk at the Dr/Hospital

or pay more now and have less risk at the Dr/hospital - What prescriptions do I take, and how are they covered?

- Do I want extra benefits like dental or vision?

- Do I plan to travel or spend part of the year in another state?

- How much does each option cost you, what is the cost of what you currently have vs what is the cost of other options available to you?

Let’s Make Medicare Simple

PHEW! I’m glad you made it though this far!

The point is!

Choosing a Medicare path is a big decision.

But you don’t have to figure it out alone. My job is to help you understand your choices and make sure you’re set up with a plan that fits your health needs, travel style, and budget.

Call or text me at 406-790-9040

Schedule online: Calendly.com/katiesutton/medicare

Leave a comment