You’ve probably heard: “Everyone must enroll in Medicare at 65.”

Not always.

If you’re still working—or covered under a spouse who’s still working—you might be able to delay Medicare Part B and save hundreds (sometimes thousands) of dollars a year. The key is knowing when it’s safe to delay and when it’s not. The rules are simple once someone translates them. That’s what I’m here for.

First, the money part (so you see why this matters)

- The standard Part B premium is $185/month in 2025. Pay it when you don’t need it, and that’s money you’ll never get back. Medicare+1

- If you delay Part B when you’re not allowed, Medicare adds a lifetime penalty of 10% for every 12 months you should’ve had it. That penalty lasts as long as you have Part B. Medicare

When it’s safe to delay Part B (and keep your wallet happy)

You (or your spouse) are still working and covered by an employer group plan with 20 or more employees.

- In this case, the employer plan pays first and Medicare can be secondary or delayed. You can enroll in Part B later with no penalty using a Special Enrollment Period (SEP). This is the most common “safe delay.” Medicare+1

You’re an active federal employee (or on a working spouse’s FEHB).

- As long as that coverage is tied to current employment, you can wait on Part B without penalty and use an SEP later. U.S. Office of Personnel Management

Tip from Miss Katie: If you’re staying on a group plan with 20+ employees, it’s usually smart not to enroll in Part B yet. Keep proof of coverage so we can use the SEP later. We’ll use form CMS-L564 when it’s time. MedicareCenters for Medicare & Medicaid Services

I would first compare the group benefits to Medicare options with Miss Katie FIRST to know which path is better for your circumstance.

When it’s not safe to delay Part B (read this twice)

Your employer has fewer than 20 employees.

- In small groups, Medicare pays first. You usually need Part B at 65 to avoid penalties and coverage problems. Medicare

COBRA or retiree coverage.

- These don’t count as coverage based on current employment. If you wait, you can face penalties and a coverage gap. Your SEP clock is based on when work/active coverage ends—not when COBRA ends. MedicareSocial Security

VA health care only.

- VA is great care, but it’s not employer coverage based on current work. If you delay Part B and want it later, you can face a lifetime penalty. Many veterans keep both VA and Medicare to have more choices. Veterans Affairs

- There are Medicare Advantage plans designed with Veterans in mind, let’s connect on this; there might be benefits you’re leaving on the table

- The VA can often times bill Medicare for some care, allowing VA dollars to stretch the way they were intended to, for more Veteran needs.

TRICARE / TRICARE For Life and CHAMPVA.

- In most cases, to keep these benefits once you have Medicare, you must have Part B. Delaying Part B can end your TRICARE For Life/CHAMPVA eligibility. Tricare+1Veterans Affairs+1

Marketplace (Healthcare.gov) or individual plans at 65.

- Once you’re eligible for Medicare, you’re expected to switch. Keeping a Marketplace plan past 65 usually means no financial help and risk of Part B penalties. Medicare+1

Your safety net: the Special Enrollment Period (SEP)

If you delayed Part B because you (or your spouse) had group coverage from current employment, you get an 8-month SEP into Original Medicare after the job or that active coverage ends. We’ll file your Part B enrollment (CMS-40B) plus your employer proof (CMS-L564). MedicareCenters for Medicare & Medicaid Services

This gives us an opend window to enroll in additional coverage. Let’s connect and we will go over all of you Medicare plan options

HSA heads-up (easy to miss, expensive if you do)

If you plan to keep working and contribute to an HSA, be careful with Part A. When you finally enroll, Part A can start up to 6 months retroactive, and the IRS says you can’t contribute to an HSA for any month you have Medicare. Plan your stop-date for HSA contributions to avoid tax penalties. MedicareIRS

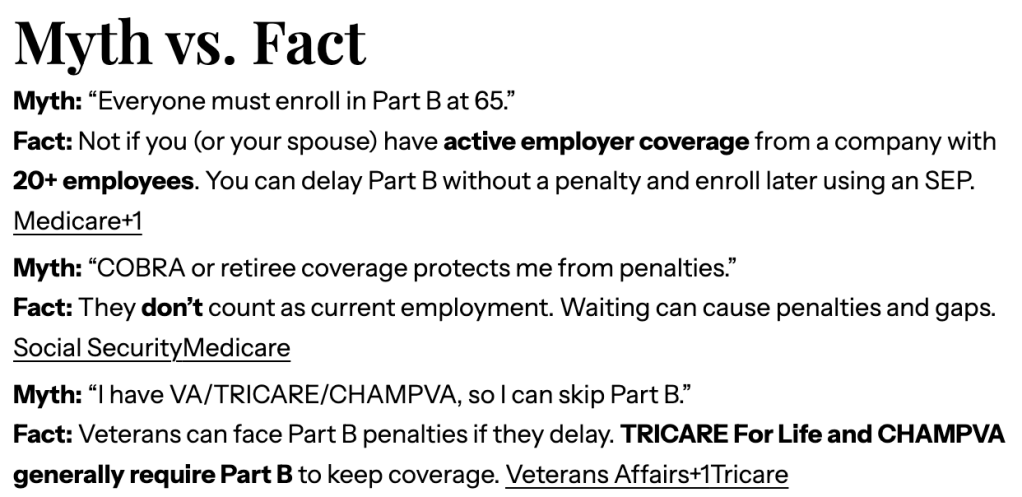

Myth vs. Fact

Myth: “Everyone must enroll in Part B at 65.”

Fact: Not if you (or your spouse) have active employer coverage from a company with 20+ employees. You can delay Part B without a penalty and enroll later using an SEP. Medicare+1

Myth: “COBRA or retiree coverage protects me from penalties.”

Fact: They don’t count as current employment. Waiting can cause penalties and gaps. Social SecurityMedicare

Myth: “I have VA/TRICARE/CHAMPVA, so I can skip Part B.”

Fact: Veterans can face Part B penalties if they delay. TRICARE For Life and CHAMPVA generally require Part B to keep coverage. Veterans Affairs+1Tricare

A note from Miss Katie (why I care so much)

One of the hardest parts of my job is telling someone they’ve paid years of Part B premiums they didn’t need—for coverage their doctors never billed—because someone told them to “do the right thing” and enroll at 65. Yes, that advice may avoid penalties for some people—but others wouldn’t have had penalties at all if they had delayed Part B the right way with creditable, active employer coverage. Let’s make sure that’s you.

What to do next (simple checklist)

- Tell me your work status (or your spouse’s), your employer size, and what plan you’re on.

- We’ll verify who pays first and if delaying Part B is safe for you. Medicare

- If delaying is smart, I’ll note your SEP and keep copies of what we’ll need (like CMS-L564). Centers for Medicare & Medicaid Services

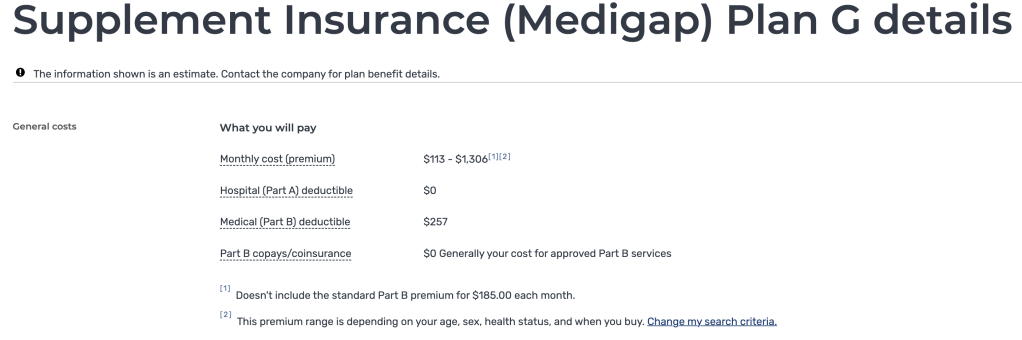

- If enrolling now is smarter, I’ll walk you through Part B and your best next step—Medigap or Medicare Advantage, and what drug coverage you may or may not need.

Talk to a real human who does this every day

I’m Miss Katie—your local insurance lady here in Billings. My goal is to protect your money and your options.

Call or text: 406-790-9040

Book online: calendly.com/katiesutton/medicare

Prefer Facebook? Message me at facebook.com/misskatiesutton.

We’ll make a plan you feel good about—no wasted dollars, no scary penalties, no guesswork.

Leave a comment