Navigating your health insurance options after age 65 can feel overwhelming. If you’re still working and have access to a group health plan, it might seem easier to stay put. But depending on your situation, moving to Medicare could actually make more financial sense.

The Cost of Part B When Paired with Group Coverage

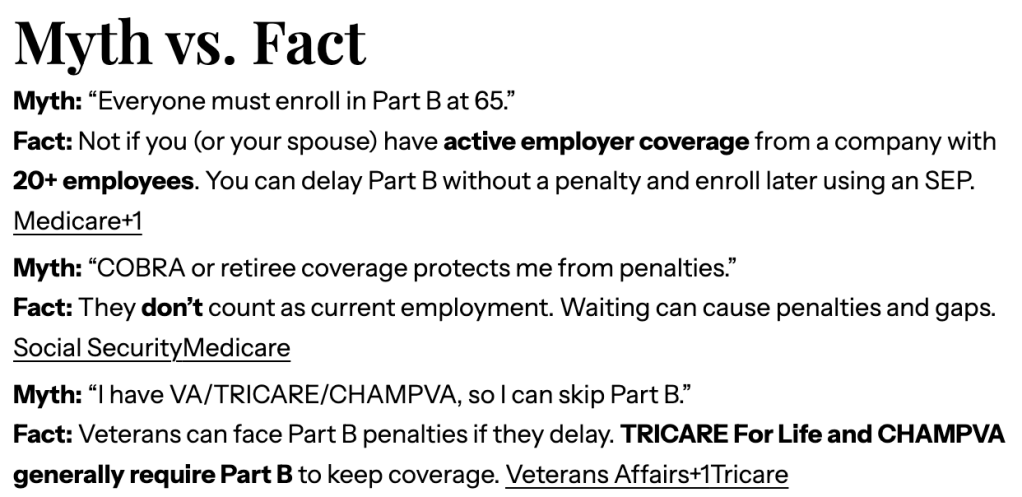

Medicare Part B comes with a monthly premium. For many, that cost in 2025 is about $185/month (though it’s higher for high-income earners). While you can be enrolled in both Medicare and an employer health plan, there’s an important rule to understand:

If your employer has more than 20 employees, Medicare becomes secondary and won’t pay for any services as long as your group coverage is active.

That means you’d be paying $185/month for Part B, but not actually using it. It’s like paying for two health plans and only getting the benefit of one.

If you’re over 65 and still working, you have a couple options:

Option 1: Stay on your employer’s group health insurance and delay Part B. This requires a letter from your HR department proving you have creditable coverage.

Option 2: Drop your group coverage and move fully into Medicare. This includes:

- Original Medicare (Parts A & B)

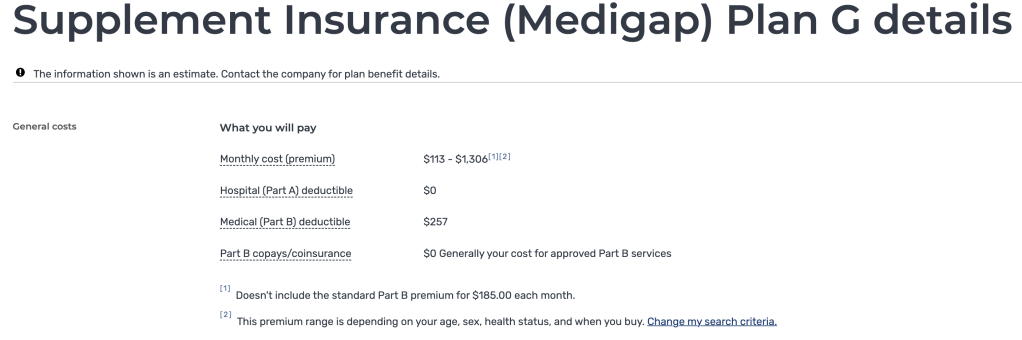

- A Medicare Supplement Plan (like Plan G)

- A Prescription Drug Plan (Part D)

Original Medicare is available at age 65 for a reason

Healthcare costs skyrocket as we age. That’s why we all pay Medicare taxes throughout our working life—to help fund the program when we need it most.

What many people don’t realize is that keeping Medicare-eligible employees on a group plan can actually drive up costs for the rest of the team. Medicare helps lighten that load.

Let’s dive into an example from this week.

In this client’s case, switching to Medicare made sense for both her and her employer:

- Her total monthly cost (Part B + Med Supp + Drug Plan) was around $300/month

- That gave her nationwide coverage at any doctor who accepts Medicare

- Her only out-of-pocket cost for the year? The Part B deductible: $257

Plus, she now has fewer denials, more flexibility, and fewer hoops to jump through compared to the group plan.

Questions to Ask Your HR Team

Waiving major medical coverage to opt into Medicare doesn’t always mean you have to give up all the other benefit options offered to you. Make sure you look into any voluntary or portable benefits like life insurance, accident plans, short term disability, critical illness or cancer coverage. If those plans can travel with you after retirement, it may be worth keeping them through your employer.

Some employers might cover your Medicare premiums because the savings to them is so high moving you off of the employer group plan, don’t be afraid to ask them the worst they can say is no!

If your employer has less than 20 employees, Medicare becomes primary and your employer coverage won’t be considered creditable coverage.

If your company has less than 20 employees Medicare is first payer and your group health insurance coverage will be even more complicated… delaying Part B is not recomended- you could get yourself into a lifetime fine and we don’t want that!

Medicare isn’t one-size-fits-all

It can feel confusing, especially when it’s time to decide whether to stick with employer coverage or make the move into Medicare.

Many employers are starting to support Medicare-eligible workers in new ways—sometimes even covering premiums for their supplement plans. As more people continue working past 65, these conversations will only grow.

If you’re unsure what makes the most sense for you, don’t go it alone. I’m here to help walk you through it, step by step.

Have questions or need a second opinion on your plan? Reach out today. Let’s make sure your coverage fits your life—not the other way around.

- “They told you to enroll in Medicare at 65…” (But that may not be right for you)

- Even us Insurance Brokers experience heartbreak | Hidden stories

- Medicare Explained 2025 | Entering Medicare? Start here

- Why Buying the Family Plot Isn’t Enough

- Why Some People Over 65 Choose Medicare Instead of Employer Coverage

Leave a comment